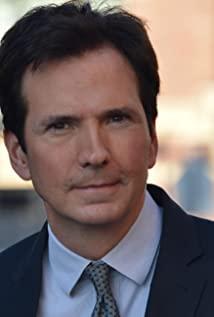

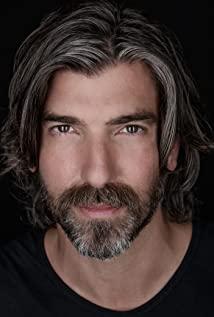

This new perspective is the insights who accurately foresee the crisis. They made a fortune in this crisis by short selling. Many people call them shameless people who make a fortune in the country, but many people think that they are true geniuses who promote social progress. Christian Bale’s Michael, a medical doctor who isolates himself from idiots by heavy metal rock, first discovered the problem; Gerrard, played by Ryan Gosling, a savvy derivative seller, everywhere The peddling product is betting that his own boss will collapse; Mark Baum, played by Steve Carell, a rude fund manager, but jealous and down-to-earth; Ben, played by Brad Pitt. The hidden expert who hates finance, but supports two keen young people behind his back.

These excellent actors make the characters brilliant and lovely. With their little brothers and their keen digital insights, the four-passengers marched upstream in this stupid carnival from the big government bank to the gangster stripper. They have unique insights, but no one recognizes them. With the market spree, their short-selling continues to lose money, bosses curse, customers withdraw funds, colleagues ridicule, and self-doubt. When the final crisis has emerged, and the investment banks they are betting on will be overwhelming. While they are making a fortune, they slap those arrogant and stubborn people. These real financial elites are extremely clever and under great pressure. They have no time or patience to make peace with you, so they are full of swear words, but with a full sense of humor. They are definitely not those mediocre people who think they are elites in suits and shoes. .

In addition to showing the extraordinary of these people, the second half of the film focuses on the pressure and difficulties of these people waiting for the crash. They have unique insights, but no one recognizes them. With the market spree, their short-selling continues to lose money, bosses curse, customers withdraw funds, colleagues ridicule, and self-doubt. When the final crisis has emerged, and the investment banks they are betting on will be overwhelmed, they are busy looking for a way to sell the CDS in their hands, in case they become waste paper as the investment banks fail. They are indeed wandering figures.

The film also did not limit the perspective to the Wall Street office. We followed the characters in the film to make field trips to the south. We visited the empty and depressed neighborhoods, contacted the lenders of readily available mortgages, and interviewed strippers who held 5 suites; the most exciting thing was that they participated in a meeting of professional revellers, allowing the spectators and The stupid revellers face off, and after discovering that their counterparties are much stupid than themselves, they take a reassurance. Information asymmetry is the most important element for making a fortune in silence. All this allows us to see the full picture of this developing crisis from all sides.

Of course, at the time of the crisis, the people were kept in the dark. At the same time as the plot is developing, the film deliberately intersperses familiar social news from the same period to reflect people's ignorance of disaster fermentation. The prosperity and decline of the financial market are cycles after another. In the ending subtitles, the CDO re-emerged and appeared again, which seems to herald the unfortunate fate of the general public will once again pay for the unwarranted disaster.

Seven years have passed since this crisis, and the scars of most people have gradually healed. Therefore, the film can review history with a pungent and humorous attitude, use sharp and fast editing to make the story more exciting and intense, and use prominent characters to contrast the ignorance of most people. In order to make it easier for the audience to participate in the plot, the film also breaks the window paper of the camera, allowing the characters to directly explain to the camera from time to time. In order to help the audience overcome the psychological barriers of financial knowledge barriers, even supermodels, chefs, singers and other well-known "outsiders" to explain, shorten the distance with the audience, let us see: this is a film that sincerely wants you A financial documentary film that understands what's going on, rather than making up mystery and piling up terminology.

If you still don't understand, I will briefly introduce it here. Buy a house loan, all understand. The amount of a single loan is small and the risk range is large. Some people think of bundling the claims of a batch of housing loans and selling them to others as bonds. This scale reduces transaction costs and diversifies risks. This is called MBS. Gradually, the loans with good credit were packaged and sold, and the idea of loans with bad credit had to be made. How to sell MBS of non-performing loans? Clever bankers invented CDO, which is to package bad credit loans into CDOs and divide them into two tranches. A-grade tranche has a low interest rate and a B-grade high. If there is a default in the whole loan, the B-grade loses first, and B After the level of loss is over, the level of A will be lost, and then they will be sold to investors with different risk appetites. Nobody wants B-level? I took a guarantee, and then I asked a rating agency to rate an AAA, and a good product is on sale again! Later, the non-performing loans are all used up, then let's sell the CDO of the CDO! It is to treat CDOs as loans (it is indeed bonds in essence) to restructure and sell them. There is no shortage of children and grandchildren. A housing loan of 50 million may be accompanied by a variety of derivatives of 2 billion. What is the problem with this kind of play? In the original loan under several layers, bad ones will default. When there are more defaults, the bottom layer of debt cannot be collected, and all the bonds superimposed on it will be ruined. When the time comes, which hapless guy holds a lot of CDOs in his hands, or makes a lot of guarantees for CDOs, it collapses, such as Lehman Brothers. On the other hand, if the loan defaults, the house will be confiscated and auctioned by the bank, which increases the supply of the housing market and depresses the housing price. There are many cases like this. People who were planning to repay the loan looked at it. Hey, the value of my house has fallen below the amount of my outstanding loan. Then I simply won't pay the money, and the house will not be repaid. As a result, houses were confiscated and entered the housing market, further lowering housing prices. In the end, the real estate collapsed and many people were left homeless.

Several smart shorts discovered these problems, so they went to various investment banks to buy something called CDS. This is an insurance in name, that is, when the insured CDO is fine, the shorts have to pay the insurance premium to the investment bank, and when the CDO crashes, the investment bank has to compensate the shorts for the loss of the CDO. However, this thing is called insurance, and it is actually short. why? Because these shorts do not hold CDOs at all. To use an analogy, you insure your house, the house burns, you claim, the gains and losses are hedged. But this house is not yours, but you buy insurance for it (you are the beneficiary) and you buy 100 copies. Isn't this a bet that the house will burn? This is essentially shorting CDO. In the days when the housing market is booming, no one thinks that CDO will collapse, so CDS is nothing but money, and investment banks are of course willing to sell it. Until the end was approaching, in addition to Goldman Sachs' recovery, before the crash, CDO also bought a lot of CDS (the story told in the movie Margin Call), and other big banks suffered a lot and even collapsed. And a few big shorts have the last laugh. You say that they are only smart and sharp, what's wrong with it? Short sellers are like woodpeckers in the financial system. They can find problems the fastest and are an indispensable driving force for economic development.

The next story is that the government took a bailout, because several big banks (plus the insurance company AIG, which issued countless CDSs) were too big and the US economy collapsed. In the end, the taxpayer's money is the bottom line. The film Too big to fail explains this process in detail, and can be enjoyed as a sequel to the film (link at the end of the article).

You ask: How can you lend money to someone who can't afford it? Because in the booming era, the creditor's rights of loans can be sold to banks (they packaged and sold to investors) when they are sold. I was able to get back the money plus interest at the time, but what did it matter to me if I couldn't repay the money in the end? In the final analysis, the problem is that the entrustment chain is too long. The person who makes the loan decision (the person who can not afford to repay the loan) and the person who bears the risk (the investor who finally holds the CDO) are separated by more than a dozen levels. The split with risk is the root cause of the disaster.

You ask: How can investment banks take over or guarantee CDOs for bad loans? Are they dizzy for handling fees? They are looking at data. With so many loans, although the interest rate is high, the default rate is not high. Why not do good business! Why is the default rate not high? Because the lender created a floating interest rate in order to lend money. The borrower paid very low interest in the first two years, so it is naturally not easy to default, and then the interest rises again, and they leave. After several floors, no one noticed this anymore. And Christian Bale’s role was first noticed, and he discovered that a large-scale rise in floating interest rates will occur in the second quarter of 2007. He is really awesome. However, large companies (banks) cannot afford to lose their tails, and it is actually very difficult to make flexible decisions. Goldman Sachs is really good at this point.

You ask: Why do the rating agencies rate AAA without a conscience? One is that they are essentially profitable companies, and they collect money and get ratings. If they are underestimated, they will look for competitors (other rating agencies). The second is the asymmetry of information. They only have a few pages of financial reports in their hands. They only know that the bank is very efficient, but they don't know what the CDO is.

You ask: Where is the government supervision? How can the government have an investment bank's brains fast? can not understand. You see the SEC employees in the film have to give Goldman Sachs an embrace. In fact, in this national carnival, only a few clever shorts in the film really saw the problem.

You ask: Why do many housing loans in the movie default, and the price of CDO is still high, driving a few big bears crazy? The explanation of the movie is that the investment banks already know that there is a problem, and they are just trying to sell it secretly, while buying CDS to hedge or even make money, which constitutes fraud. This is not necessarily the case in reality. The price of CDOs is determined by the mathematical model of investment banks. When the model is too complicated and has errors, the calculated CDO price cannot accurately reflect the underlying loan situation. So until the crash, the price of CDO may not fluctuate greatly.

You ask: Are those big banks really damned? It's that they are playing off, but they are also miserable (except Goldman Sachs), which indirectly shows that they are not deliberately cheating. But it is an indisputable fact that they have to use taxpayers' money to save them.

You ask: Then who should be responsible and who should go to jail? nobody. This is the common result of the failure of the pricing model, the excessively long commission chain, and the irrational fanaticism of market participants. No one has clear evidence of fraud. The most critical issue is too big to fail, that can only encourage the spin-off of big banks after the rescue.

then what should we do? Strengthen supervision. But being too strong will restrict market freedom and hinder development. The development is slow, the deregulation, the collapse of the game, and the strengthening of supervision are the unbroken cycle, which is also the destiny of the financial industry.

How do we ordinary people know the bloody storm inside? At the same time as the plot is developing, the film deliberately intersperses familiar social news that happened at the same time to reflect that the general public knows nothing about the fermentation of this disaster, but they have to pay the bill in the end.

Related articles:

"too big to fail" - the non-literary and art circles perspective of the financial crisis

, "Inside Job" - Wall Street siege of literary and art circles, I'll wash for Wall Street (the reason)

attached video-based paper said defuse the "big "Short" link:

http://www.bilibili.com/video/av5399021/

WeChat public account: feidudumovie (feidudumovie)

View more about The Big Short reviews