It coincides with the theme of Henry Paulson's autobiographical memoir 5 years later: on the brink, which I revisited yesterday. Today at FT, I saw that the US government has asked Blackrock to manage the IG Corp Bond that it wants to buy in large quantities. It mainly involves three transactions, Maiden Lane transactions, and one of them is about Lehman and JPM, and the other two are related to AIG. This just corresponds to the theme of the movie...and the Big Short or MarginCall that I have seen before. From the perspective of transaction investment, etc., this movie relives the financial crisis from the perspective of national policy makers. Although the perspective of looking at the crisis is different, but The same is the irony of investment banks that are getting bigger and harder to supervise... Look at today's situation, the Treasury and the Fed are no longer as hugely restricted by Congress as they used to be (checks and balances because of the subtle changes in the current White House) ?) ... Times are progressing and the financial system is becoming more stable (at least that's what we heard), but have people really changed? Whether the rules set by previous regulators during the crisis can be easily changed (Dodd Frank, but now it seems less likely to release water in the $6 trillion)

"Those who do not learn history are doomed to repeat it." - George Santayana

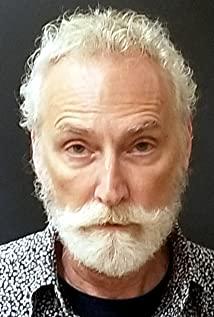

View more about Too Big to Fail reviews