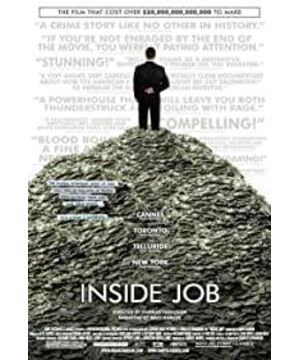

Back then, the collapse of Lehman Brothers dominated the news, and it has been 11 years since the 2008 financial crisis. How did the original crisis happen, and what role did ordinary individuals, investment bankers, academia, government agencies, credit rating agencies play in this disaster? This movie also gave us a good inspiration.

It turns out that when banks give loans to individuals, they pay great attention to the repayment ability of individuals. After all, mortgage payments take decades. However, since Wall Street investment banks securitized housing loans, housing loans have become a tradable financial commodity, so the standards for banks to review loans to individuals are getting lower and lower. Can apply for a loan. But that doesn't matter, after all, the loans can be sold to Wall Street investment banks if they change hands. Wall Street investment banks packaged the loans they received into CDOs, or asset-backed securities, and sold them to market investors. Lehman Brothers, Morgan Stanley, JPMorgan Chase, Merrill Lynch, etc. are the initiators of this disaster.

And the corresponding supervision departments such as securities supervision that should play a regulatory role, because the executives of these departments are also from Wall Street, so they have no interest in supervision at all. In addition, Wall Street has sent a team of several thousand lobbyists to lobby the top government officials to allow them to legislate to loosen financial regulations. And among these lobbyists, there are many people in the academic circles, who provide corresponding academic research to provide a strong endorsement for the relaxation of financial supervision, and accordingly these professors in the university have also gained a lot.

For individual consumers, the house is like a dream. Now this dream is within easy reach of their own eyes, and everyone has entered the market. Under the floating interest rate, the up-front payment only needs to be very small, but Over time, the required share of the burden will also increase. As a result, more and more people are defaulting. In the CDOs sold on Wall Street, since they are all packaged for sale, no one knows whether they are good or bad. For example, it is like putting a few rotten fruits in a pile of good fruits, and it is not easy. Found, but one day when the rotten fruit starts to grow.

When it was discovered that day, the market crashed.

Ordinary individuals, academia, government agencies, executives of Wall Street companies, and credit evaluation agencies all play different roles in this system. It seems that except for ordinary individuals, everyone makes a lot of money. The initiators of the disaster, the executives of the major companies on Wall Street, have nothing to do, and the rich get rich and get promoted. But there are hundreds of ordinary people who have to bear these responsibilities and pay for it. Of course, ordinary people don't have a little responsibility, and that's not necessarily the case. However, after the tsunami, whether we can reflect on whether we can change the current situation, I think it is difficult to change, because after all, these people who created this tragedy still hold the power.

And ordinary people will forget over time, and then the next tragedy will play out.

View more about Inside Job reviews