Look down one place at a

time: At the beginning of the film, I gave a close-up of the exchange, and at the same time typed the time: 1985. Numerous big-head computers in the exchange display the market in green letters. At the counter below, a teller is filling out the receipt. In the open space, some people gathered around and whispered, apparently discussing the news of the stock market, what should be bought and sold. The lens is quite concise, just a few seconds, but it has outlined the most important financial hub of the United States in that era.

First of all, this place should be the New York Stock Exchange. Among the major stock exchange markets in the United States, only the trading venues of all entities on the New York Stock Exchange are available. Others such as NASDAQ rely on computer networking to form a virtual market. The reason is also very simple. The establishment of the New York Stock Exchange is the earliest of several exchanges in the United States: 1817. In the beginning, securities dealers sat down and traded together, and this tradition has been preserved.

The protagonist goes to work in the company, and the company’s stock abbreviations and prices are scrolled in green on the company’s screen. If you pay attention, you will find that the price is very characteristic, all ending in 1/8, 5/8, 1/2, etc., such as 38 1/2. This detail is very good. The reason for such a price is because of the regulatory requirements of the US Securities and Exchange Commission (SEC) that the smallest unit of stock quotes is 1/8 US dollars and its integer multiples.

The position of the protagonist was quickly revealed, a struggling small trader. The floor he is on is the trader’s floor. It has many typical features. Everyone is busy answering one or several calls at the same time, yelling at each other or comparing prices with gestures, asking colleagues about the selling price of a particular stock. Or the purchase price, the loudspeaker announces some important information, the whole scene looks extremely chaotic to outsiders but has its own order. The reason why the protagonist is a small trader is that he has no regular clients yet, completely turning the yellow pages to do telemarketing one by one, and constantly harassing the famous Gekko every day.

The protagonist had a bad day and went to see his father. In the tavern, my father complained that he was in the wrong business and became a salesman. The protagonist was young and vigorous and responded sensitively that I was not a salesman, I was an account executive, and soon Go to the investment banking department. Judging from the previous protagonist’s working environment, he was engaged in the work of a trader. On Wall Street, until the early 1980s, traders were still looked down upon. Because the work content is relatively simple, and long-term people with very low cultural qualities, such as Irish immigrants, the stereotype of traders can be said to be red noses, short stature, alcoholism, and loud voices, forming a unique and vulgar trader culture . Traders usually occupy one or several floors with open office space. The film begins to portray the traders’ floor very vividly. Traders truly became an enviable profession in the mid to late 1980s. With the rise of bonds and derivatives, traders’ salaries quickly reached the million level. A large number of high-quality Harvard and Wharton students chose to engage in this industry. Investment banks are totally another world. The general impression that Wall Street investment banks give people is that financial elites, with high salaries, travel around the world in suits, special cars, five-star hotels, and chat and laugh with bigwigs from all walks of life. Under such circumstances, the unhappy protagonist will inevitably have to separate himself from the salesperson, and finally emphasize that he is about to enter investment banking out of thin air.

Junk bonds have a more elegant name: high-yield bonds. This variety was invented out of nothing by the famous American securities wizard Milken and became a mainstream bond variety. It was popular in the 1980s and one of its main uses is leverage buyout. Through the issuance of junk bonds, the acquirer can complete the acquisition of large companies with very little of its own funds, such as KKR's acquisition of a famous Oreo manufacturer. Nabisco, the total amount of acquisitions is close to 30 billion U.S. dollars, but KKR's actual investment is only 2 billion U.S. dollars, and the remaining funds are raised by investment banks to provide bridge loans or issue junk bonds. In short, the 1980s was a golden age for junk bonds. When Bud first met Gekko, Gekko knew that Bud worked for Jackson Stein, a brokerage firm, and said that your junk bond department was good. This sentence, combined with Gekko's previous phone call, has actually hinted at what Gekko did.

Gekko was engaged in the hottest profession in the 80s, PE. The full name of PE is private equity, which raises funds from non-public channels and then invests. In the 1980s, PE in the United States was almost synonymous with leveraged buyouts. In this period, all the popular figures in the PE industry, such as KKR and Blackstone, were all borrowing heavily to acquire companies, and the scale of acquiring companies was getting bigger and bigger. The high profits are also staggering, often ranging from ten times to dozens of times or even hundreds of times. When Gekko met Bud, the call was to buy Teldar Paper.

At least two acquisitions were also involved in the film. One was Whiteman's acquisition of Anacott Steel. As Bud learned that Whiteman went to meet with Anacott's management to discuss the terms, Gekko entered the market and raised the stock price, and finally killed Whiteman severely. One hit; the second is that Bud promoted Gekko's acquisition of Bluestar. After discovering Gekko's treachery, Bud, under his conscience, helped Whiteman gain control of Bluestar.

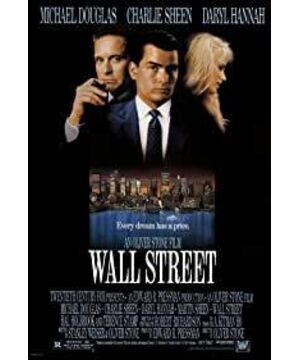

The whole Wall Street is full of enthusiasm, almost like the Ukiyo-e of Wall Street Finance in the 1980s, which profoundly explains what capitalism is, and the complicated relationship between money and human nature. The most exciting part of the film is Gekko's speech at the Teldar Paper shareholder meeting. He said: I am not a destroyer of companies, I am a liberator of them! The point is that greed is good,greed is right, greed works. Greed clarifies, cuts through and captures the essence of evolution spirit. And greed will not only save Teldar paper but that other malfuntioning corporation called the USA.

Douglas performed this passage perfectly, unabashedly and justified his greed. This magnanimity can be called a kind of belief, and it is also Gekko's behavioral logic. Because of greed, he can work hard to bring Teldar back to life, and because of greed, he can dismember Bluestar. There is no right or wrong and morality in Gekko's heart, or there is no secular right or wrong and morality. He used business rules and financial rules to satisfy his bottomless desires. In reality, because PE predators use the rules of the game to use the rules of the game, it has also aroused huge controversy. Should there be sanctions for only capitalism but no morality, which only seeks personal gain and makes a large number of hardworking workers unemployed?

Bud asked Gekko: how much is enough? To

be able to ask this sentence, Bud will still be Bud, and will not become the Gekko he once admired.

View more about Wall Street reviews